Pricing

Evaluate your products with state-of-the-art models

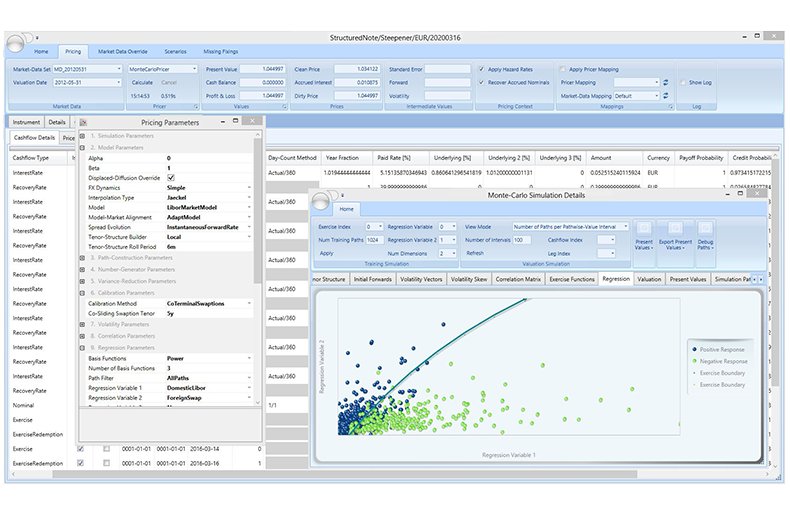

Aquantec Ocean combines tried and tested pricing algorithms with a flexible analysis framework to evaluate financial products and portfolios of trades or positions. Parallelized valuations can be either performed locally or distributed with the help of a Calculation Service.

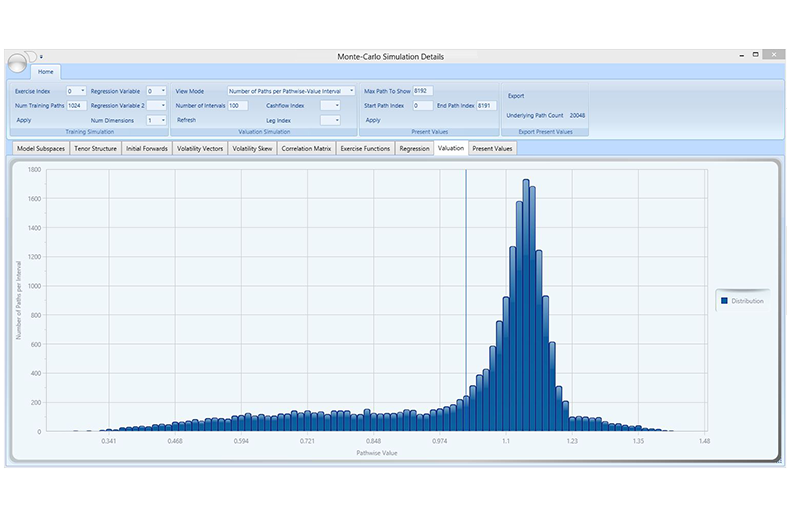

Plain-vanilla products and exotics such as barrier and basket options are priced with fast analytical algorithms, whereas structured products are evaluated with powerful pricers utilizing Monte-Carlo, finite-difference, and finite-element techniques.

An extended cross-currency displaced-diffusion LIBOR market model allows modeling of a low-interest-rate environment with volatility skews even for multi-currency and hybrid products.

A time-dependent Heston model allows pricing equity and foreign-exchange derivatives with American exercise rights employing stochastic volatilities.

Financial products can be mapped collectively or individually to pricers and their configurable pricing parameters. Several different pricer mappings may be used to assess model risks.

The present-value calculation takes credit risks as well as cancellation rights into account and provides a multitude of pricing details, e.g., exercise probabilities and cashflow estimations. In addition, many other profit-and-loss figures and balance-sheet values such as accrued interest and cash balance are calculated.

Software for Pricing and Trading,

Portfolio and Risk Management

Highlights

- State-of-the-art pricing models and numerical algorithms

- Proven track record of evaluating large cross-asset portfolios of banks and insurance companies

- Consistent application of default probabilities and recovery rates to model credit events

- Parallel and distributed execution of pricing algorithms