Portfolio-Data Management

Gather your whole portfolio in one system

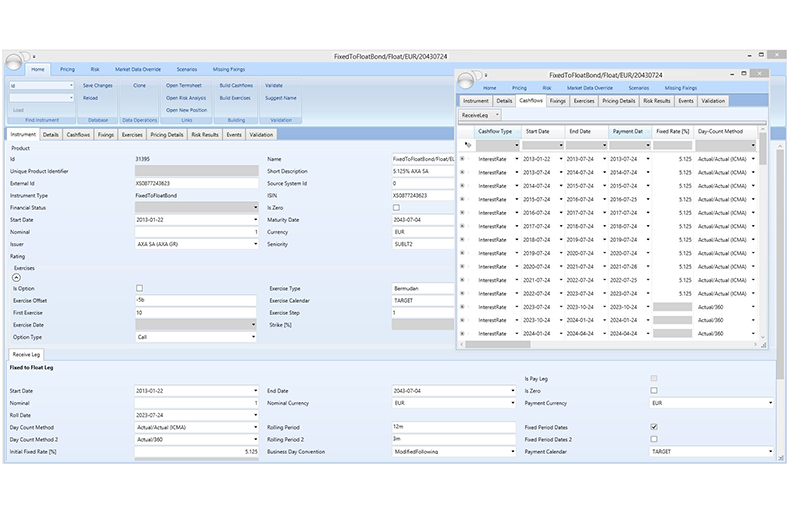

Management of financial products

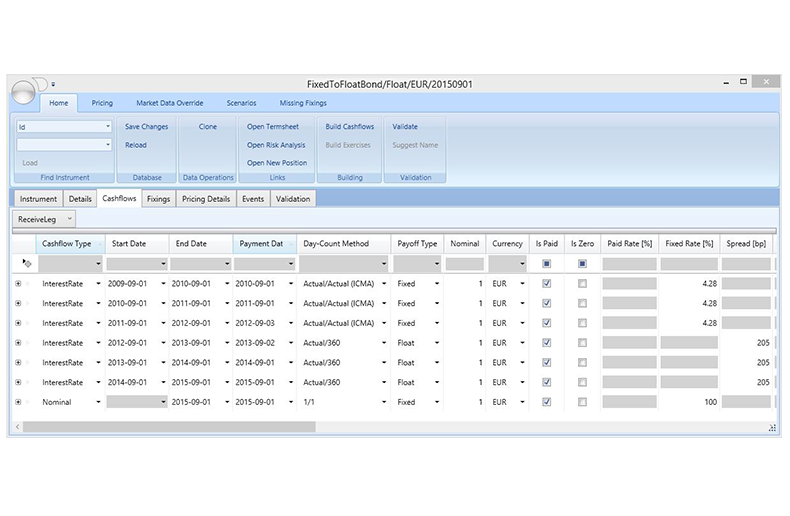

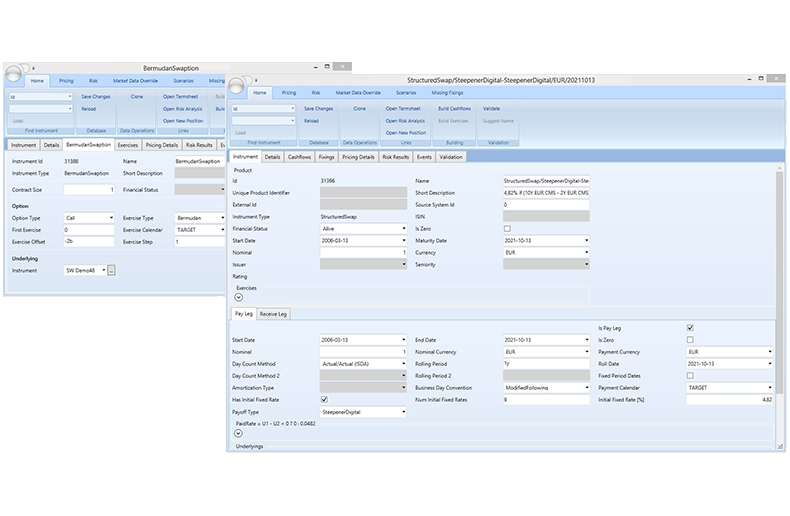

Aquantec Ocean allows for the representation and maintenance of a broad range of financial products. The entire product range – from simple to highly complex – is captured in one generic data model and comprises products from all asset classes such as

- interest-rate products from plain-vanilla bonds to structured swaps,

- foreign-exchange products from FX forwards to FX option strategies,

- equity products from stocks to barrier options and equity-linked notes,

- credit products such as single- and multi-name credit-default swaps,

- inflation swaps and inflation-linked bonds,

- and real-estate and other illiquid products.

Intuitive user interfaces facilitate manual entry, customizable workflows steer bulk imports. Fixings and exercises are monitored and updated with corresponding query managers.

Aquantec Ocean is familiar with all business and market conventions used for the precise generation of payment schedules and the exact calculation of cash-flow amounts.

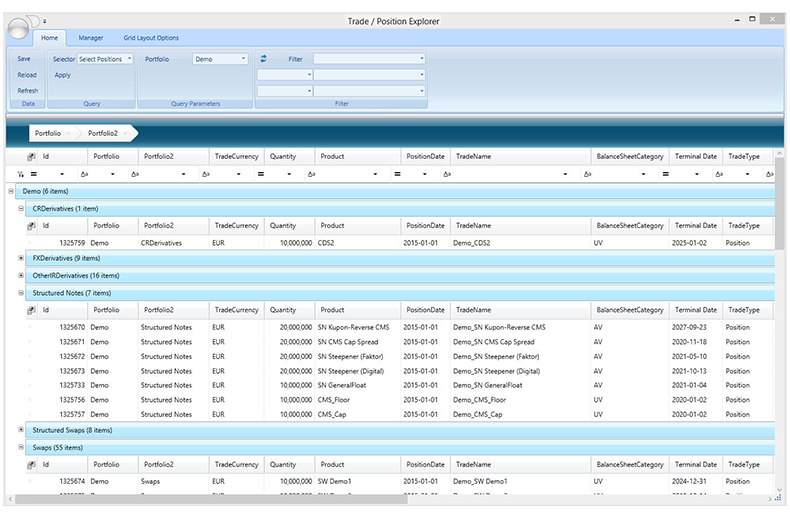

Management of trades and positions

Aquantec Ocean supports capturing and life-cycle management of portfolios given by individual trades or positions in assets and liabilities. As is the case with financial products, trades and positions can be manually entered or automatically created via file-based bulk imports.

Categories and hierarchies can be defined in order to reveal or impose a structure on a portfolio. The portfolio explorer provides various flat and hierarchical views. Filter mechanisms enable the user to focus on sub-portfolios.

Management of reference data

Product and trade data rely on reference data. Relevant reference data comprise currencies, business calendars, parties, seniorities, ratings, and category data. In addition, comprehensive lookup data, e.g., for day-count methods and business-day conventions, are provided.

Software for Pricing and Trading,

Portfolio and Risk Management

Highlights

- Capturing portfolios of financial assets and liabilities within one system

- Precise generation and monitoring of fixings, exercises, and payments

- Convenient bulk import and export of products and positions